Tech News

PayPal Now Has Money Pooling for Groups

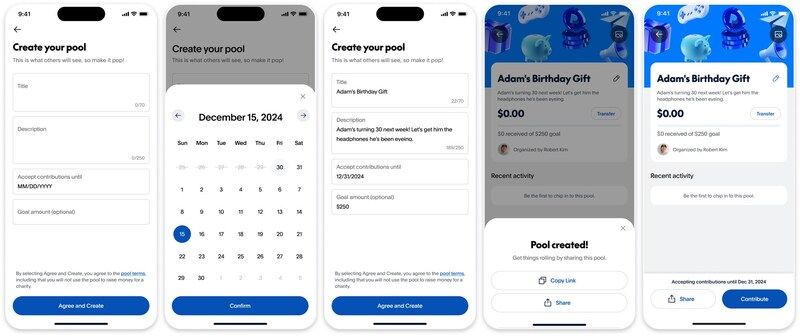

PayPal has introduced a new feature for group money management. This feature, called Money Pools, lets people collect and manage funds as a group.

PayPal's Money Pools feature could be used for anything, like shared expenses such as group gifts, travel costs, fundraising, special events, and other collective purchases. You can create a pool, set a target date, and optionally specify a goal amount to reach. A unique link is then generated, which can be shared with participants through text, email, WhatsApp, and any other messaging services.

What's interesting is that pool members don't need a PayPal account to participate; contributors can fund the pool using their PayPal balance or a linked bank account. Once funds are collected, the pool organizer can transfer the total amount to their PayPal balance for spending or withdrawal to a linked bank account. The service is currently being rolled out to users in the US, Germany, Italy, and Spain, and it is accessible online or through the PayPal app.

PayPal added this feature after internal research showed a major demand for the group pool feature. A 2024 survey conducted by the company revealed that US consumers engaged in group money pooling approximately 86 million times during the previous year using their own accounts. Popular uses included group gifts, shared travel expenses, and costs associated with events like concerts and sporting events.

The service is free to use, both for creating and contributing to a pool. It is also backed by PayPal's existing fraud monitoring and encryption measures that protect peer-to-peer payments on the platform. PayPal mentioned in its announcement that if users aren't comfortable with this new feature, they can continue to use the app to check their balance and send money. The feature will not change anything about the regular service.

Source: PayPal

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments